A little while ago, we published a case study on how Natural Language Processing (NLP) has been helping our insurance clients gain valuable insights from inbound calls, and how this can help them transform various aspects of their business.

Fast forward a few months later, and Generative AI has already begun taking over the narrative where digital transformation is concerned.

Today there’s an exciting opportunity for enterprises to augment Discriminative AI with Generative AI. Prompt engineering and fine-tuning of foundational Large Language Models (LLMs) with enterprise data can enable insurance companies to reinvent most parts of their value chain.

NLP + Generative AI = The Barbenheimer effect?

It’s important to note that over time NLP has progressed from simply understanding and analyzing text to generating intelligent and contextually appropriate responses, summaries, etc. Traditionally, it focused on tasks such as text classification, sentiment analysis, and information extraction.

Traditional NLP and Generative AI, each on their own, are capable of providing immense value to insurance companies. But by combining forces, Generative AI and NLP have now enabled machines to create human-like text and generate meaningful responses. Together, they can empower insurance teams to tackle foundational and complex tasks with newfound intelligence.

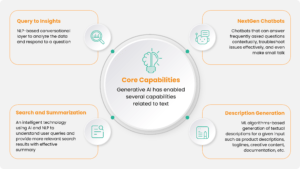

Enterprises have a huge opportunity to customize the available foundational models to realize value from a broad range of capabilities that Generative AI offers.

At Tiger Analytics, we use the following approaches based on our clients’ use cases:

- Prompt Engineering using Enterprise-grade Generative Models – e.g.: Chain of thought, zero-shot examples, few-shot examples

- Prompt tuning using any of the open-source LLM models – e.g.: Prompt tuning, Prefix tuning, and PEFT

- Fine-tuning an open-source LLM model for a specific task – e.g.: Causal Language Modeling (CLM) and Masked Language Modeling (MLM) on objectives like summarization, code generation, etc.

- Building a foundational LLM model with multiple tasks capability using RLHF loop.

4 Process Wins for the Insurance Industry

We’ve worked on Generative AI projects involving search and summarization, description generation, and next-gen chatbots for various clients. Here are four processes that Generative AI + NLP can help transform:

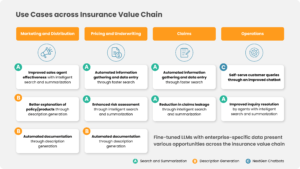

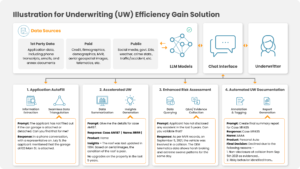

Process Win #1: Pricing and Underwriting

With automated information gathering and data entry, insurers can now expedite the search process, leading to faster and more accurate access to crucial data points — and it’s all thanks to Generative AI.

Furthermore, Generative AI’s intelligent search and summarization capabilities enhance risk assessment by swiftly analyzing vast amounts of information and extracting key insights. This streamlines the underwriting process while improving decision-making accuracy.

Generative AI also enables automated documentation through description generation, reducing the need for manual report writing, and thereby reducing the risk of human errors. As a result, insurers can make better pricing and underwriting decisions.

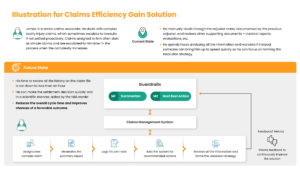

Process Win #2: Claims Processing

Traditionally, adjusters would spend hours manually reviewing adjuster notes and other supporting documents, resulting in delays and potential claims leakage. However, with Generative AI, the game changes. Through automated information gathering and data entry, insurers can leverage faster search capabilities to access relevant information swiftly. Market studies indicate that Generative AI can reduce the time spent reviewing claim files to less than an hour.

Generative AI’s intelligent search and summarization capabilities also go a long way to enable adjusters to extract and analyze key insights, minimizing the risk of claims leakage. This, coupled with a sophisticated Next Best Action (NBA) model, helps adjusters make settlement decisions quickly and scientifically. The impact is profound — insurers can now streamline claims processing, ultimately reshaping the claims landscape in the insurance industry.

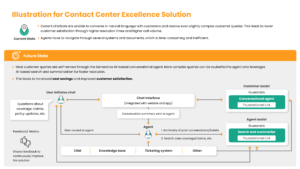

Process Win #3: Contact Center Operations

Generative AI can help overcome many current challenges such as the limited conversational abilities of chatbots and the need for agents to navigate multiple systems and documents. With the implementation of a conversational agent, a major portion of customer queries can be self-served, resulting in reduced resolution times. Even more complex queries can be seamlessly routed to agents, ensuring personalized customer experiences.

Also, Generative AI can empower agents with intelligent search and summarization capabilities, making sure they can access relevant information and deliver accurate responses.

Process Win #4: Marketing and Distribution

Traditional chatbots often struggle to provide natural language conversations, hindering their ability to answer product queries. But by working with Generative AI, the effectiveness of sales agents can be improved, equipping them with quick access to relevant information and enabling them to provide accurate and personalized responses. Generative AI can help address critical marketing and distribution challenges for enhanced customer engagement.

Generative AI facilitates better explanations of policies and products through automated description generation, reduces administrative burden, and frees up valuable time for sales agents. Ultimately, insurers are equipped with the technology firepower to deliver consistent and contextual customer journeys across touchpoints, creating tailored experiences that align with individual preferences.

Just as the iPhone revolutionized human interaction with technology, Generative AI is poised to revolutionize the insurance landscape by simplifying and accelerating the digital transformation journey for insurers. Paired with NLP capabilities, it will help change the way insurers automate and expedite key workflows, ranging from risk assessment to claims processing and underwriting. Our brave new world is here.