The last few years have seen a rapid acceleration in the use of disruptive technologies such as Machine Learning and Artificial Intelligence in financial institutions (FI). Improved software and hardware, coupled with a digital-first outlook, has led to a steep rise in the use of such applications to advance outcomes for consumers and businesses alike.

By embracing AI/ML, the early adopters in the industry have been able to streamline decision processes involving large amounts of data, avoid bias, and reduce chances of error and fraud. Even the more traditional banks are investing in AI systems are using state-of-the-art ML and deep learning algorithms that have paved the way for quicker and better reactions to the changing consumer needs and market dynamics.

The Covid-19 pandemic has only aided in making the use of AI/ML-based tools more widespread and easily scalable across sectors. At Tiger Analytics, we have been at the heart of the action and have assisted several clients to reap the benefits of AI/ML across the value chain.

Pilot-use cases where FIs have seen success by using AI/ML-based solutions:

- Smarter risk management

- Real-time investment advice

- Enhanced access to credit

- Automated underwriting

- Intelligent customer service and chatbots

The challenges

While time, cost, and efficiency have seen drastic improvement thanks to AI/ML, concerns over transparency, accountability, and inclusivity prevail. Given how highly regulated and impactful the industry is, it becomes pertinent to maintain a sense of clarity and inclusiveness.

Problems in governance of AI/ML:

- Transparency

- Fairness

- Bias

- Reliability/soundness

- Accountability

How can we achieve this? By, first and foremost, finding and evaluating safe and responsible ways to integrate AI/ML into everyday processes to better suit the needs of clients and customers.

By making certain guidelines uniform and standardized, we can set the tone for successful AI/ML implementation. This involves robust internal governance processes and frameworks, as well as timely interventions and checks, as outlined in Tiger’s response document and comments to the regulatory agencies in the US.

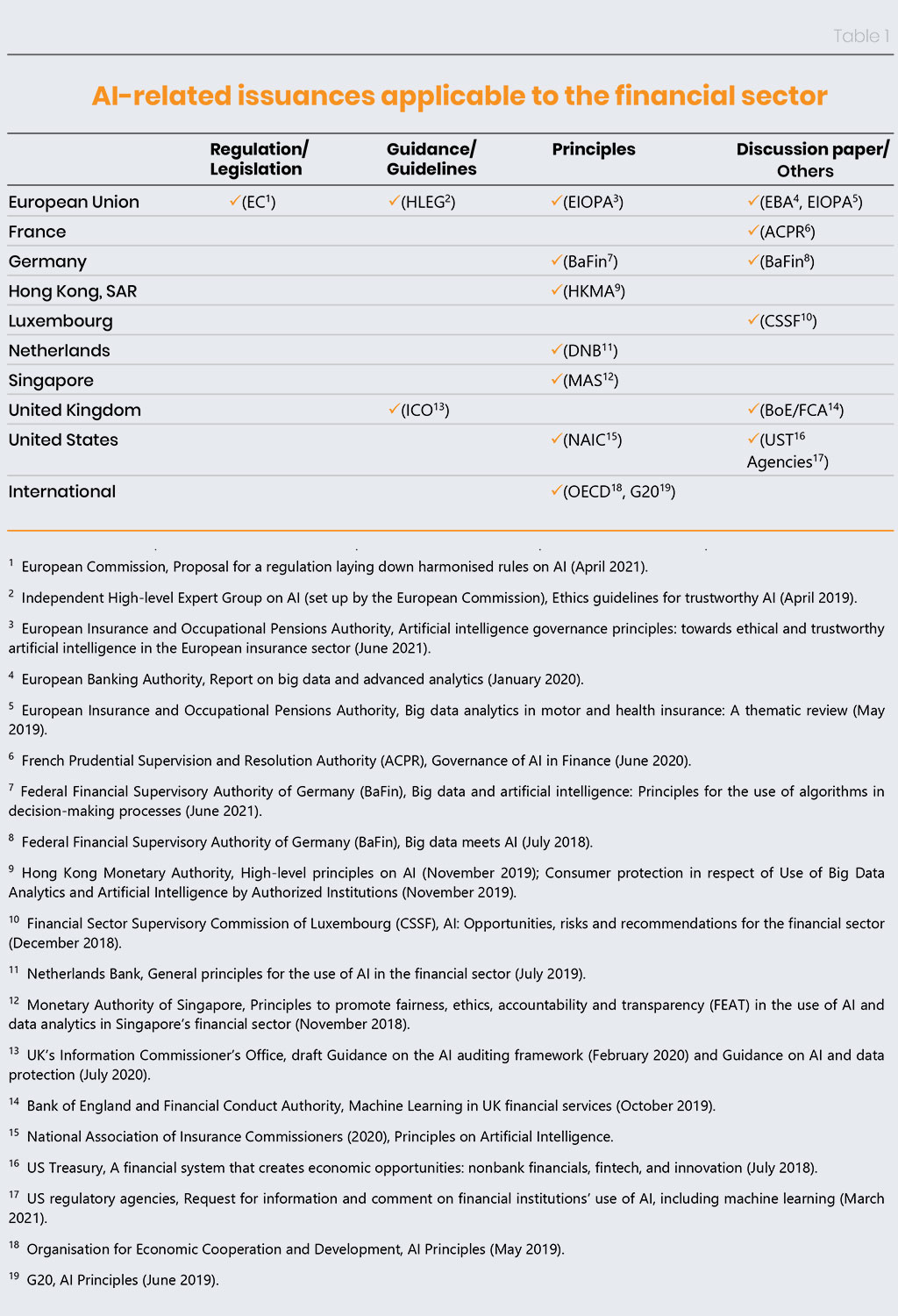

These checks become even more relevant where regulatory standards or guidance are inadequate specifically on the use of AI in the FI. However, efforts are being made to hold FIs against some kind of standard.

The table below illustrates the issuance of AI guidelines across different countries:

Source: FSI Insights on Policy Implementation No. 35, By Jeremy Prenio & Jeffrey Yong, August 2021

Supervisory guidelines and regulations must be understood and customized to suit the needs of the various sectors.

To overcome these challenges, this step of creating uniform guidance by the regulatory agencies is essential — it opens up a dialogue on the usage of AI/ML-based solutions, and also brings in different and diverse voices from the industry to share their triumphs and concerns.

Putting it out there

As a global analytics firm that specializes in creating bespoke AI and ML-based solutions for a host of clients, at Tiger, we recognize the relevance of a framework of guidelines that enable feelings of trust and responsibility.

It was this intention of bringing in more transparency that led us to put forward our response to the Request for Information and Comment on Financial Institutions’ Use of Artificial Intelligence, including Machine Learning (RFI) by the following agencies:

- Board of Governors of the Federal Reserve System (FRB)

- Bureau of Consumer Financial Protection (CFPB)

- Federal Deposit Insurance Corporation (FDIC)

- National Credit Union Administration (NCUA) and,

- Office of the Comptroller of the Currency (OCC)

Our response to the RFI is structured in such a way that it is easily accessible to even those without the academic and technical knowledge of AI/ML. We have kept the conversation generic, steering away from deep technical jargon in our views.

Ultimately, we recognize that the role of regulations around models involving AI and ML is to create fairness and transparency for everyone involved.

Transparency and accountability are foundation stones at Tiger too, which we apply and deploy while developing powerful AI and ML-based solutions to our clients — be it large or community banks, credit unions, fintech, and other financial services.

We are eager to see the outcome of this exercise and hope that it will result in consensus and uniformity of definitions, help in distinguishing facts from myth, and allow for a gradation of actual and perceived risks arising from the use of AI and ML models.

We hope that our response not only highlights our commitment to creating global standards in AI/ML regulation, but also echoes Tiger’s own work culture and belief system of fairness, inclusivity, and equality.

Want to learn more about our response? Refer to our recent interagency submission.