Authors: Harini Shekar, Sunder Prabhu

Pandemic Effect

Recently, my 12-year-old had to write an essay as a part of his school assignment. Not surprisingly, he chose the topic “Positive Impact of Technology in the age of COVID-19”. The essay included his own digital experiences over the last nine months – the entire stage went digital – from curricular to the extra-curricular. From binge-watching his favorite shows on OTT platforms to buying his favorite snacks and supplies from Amazon, my kid picked up a new skill or two during this pandemic. One such skill is how he started assessing the product reviews and comparing the prices before making a purchase.

COVID-19 has brought in a new wave of such young digital tech-savvy consumers who will force brands to rethink taking control of consumer experience rather than relying on retailers. It entails knowing your consumers, putting them at the center, and strengthening the buyer-seller relationship. CPG brands must shift their thinking from ‘Point of Sale’ to ‘Point of Experience,’ a case in point being “Dollar Shave Club,” which disrupted the men’s grooming market, making Unilever acquire them for a reported $1 billion. To accomplish customer-centricity, brands should understand and connect directly with consumers.

Consumer Connection Journey

CPG brands have been trying to venture into the Direct-to-Consumer channel for over a decade now. The Nikes of the CPG world had some success with brand eCommerce channels. It is no longer a debate within the leadership of CPG giants on the need for the D2C channel. However, D2C revenue remains a small percentage for most companies. This is primarily because the path to D2C is a hard one. It requires significant organizational changes, investments into technology, building agile business processes, and responsive supply chains. CPG brands have to focus on the following essential capabilities as part of their consumer engagement journey.

Traditional CPG companies can start their D2C journey with the B2B2C model partnering with Amazon. While this still translates to treating Amazon like any other retailer, there are valuable lessons to be learned operating in the D2C world. This partnership with Amazon will be beneficial in the long run. While the journey starts with Amazon, the CPG companies must slowly establish their own eCommerce channels by starting to collect their consumer information. Generally, for most companies, the split of business between Amazon and the brand D2C will be 85%-15% to start with, with the D2C share growing over a period of time. Let’s take a look at how CPG brands can be successful in Amazon using AI.

Relationship with Algorithm

Amazon is obsessed with consumers. Their product search algorithm knows exactly what the consumer wants. Unlike partnerships with retailers, CPG companies need to understand how the Amazon search algorithm works and develop a strategy to make the most of it.

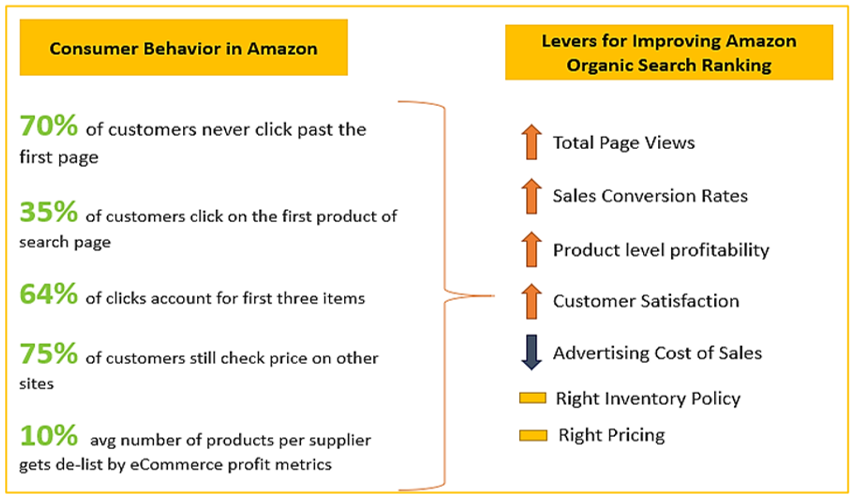

It is easy to fall into the trap of ‘unlimited shelf space’ in Amazon. The table below shows consumer behavior in Amazon. It is critical to raise your products from the clutter to the top to make a sales conversion. The competition is immense, with large and small players (including digital disruptors) competing to win the customer, as against brick-and-mortar retailer stores. Some of the drivers for increasing organic search ranking are listed in this table.

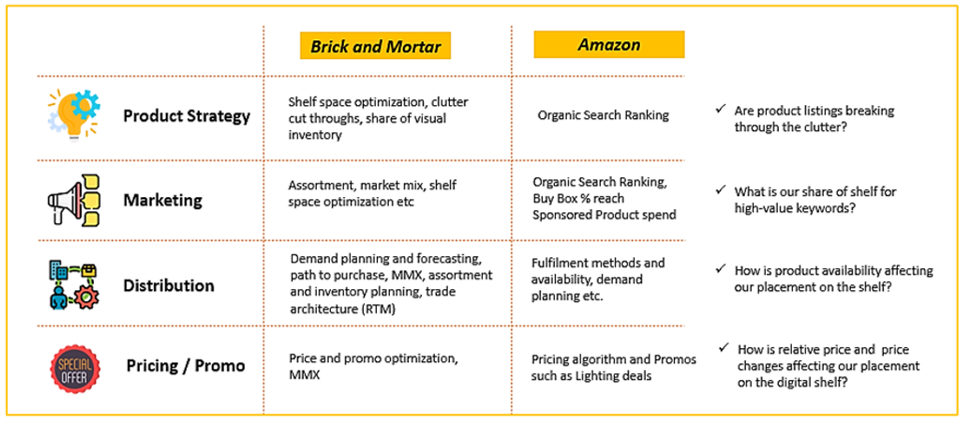

Also, CPG brands must relook at people, processes, and tools across different functional areas for success in Amazon. Some of the imperatives on how the approach changes between Brick-and-Mortar and Amazon are listed below:

How can AI help

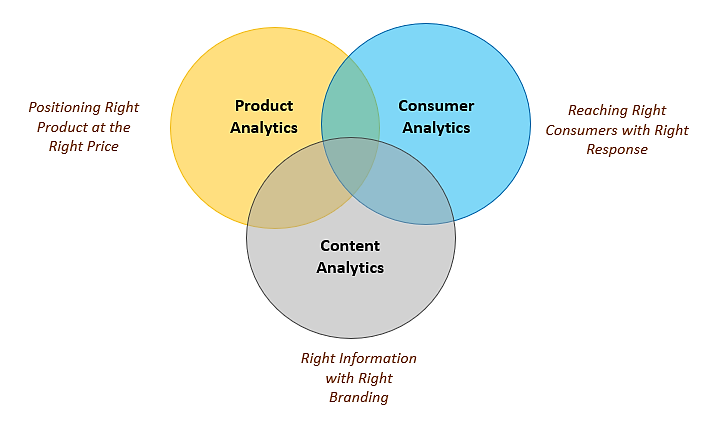

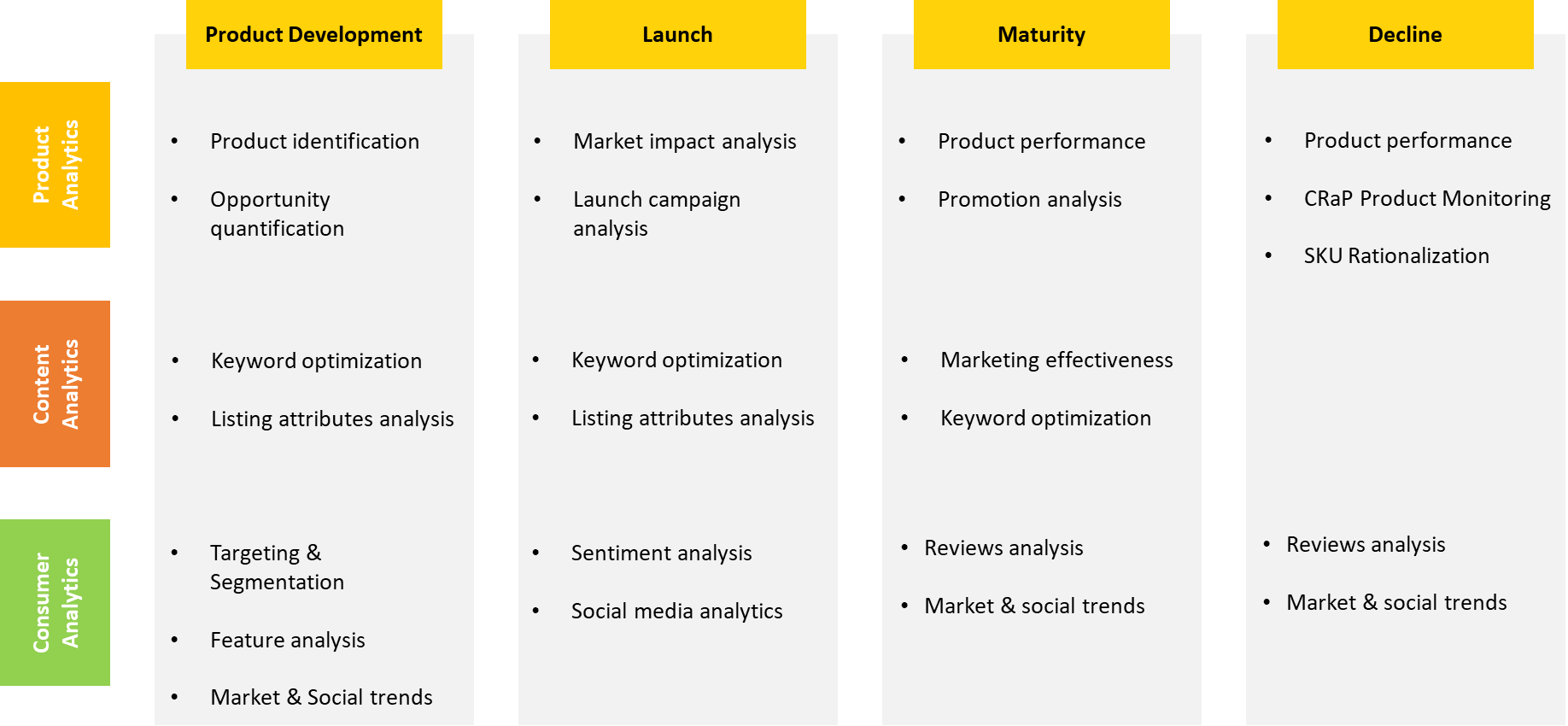

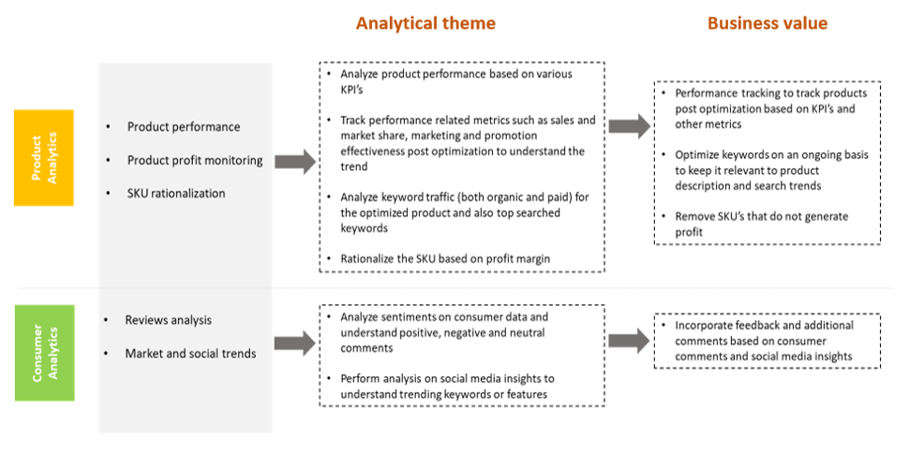

To be successful in Amazon, brands need to develop three capabilities – Product Analytics, Content Analytics, and Consumer Analytics.

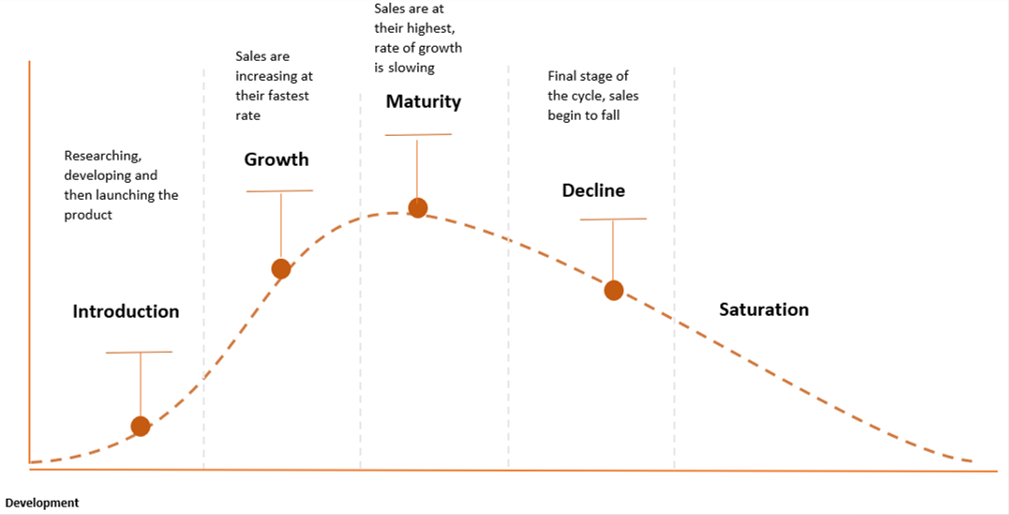

The strategy will vary based on where the product is in the product life cycle. For example, a brand-new product will market differently than a well-established, mature product. On the one hand, the marketing will focus on raising awareness, while on the other, it’ll focus on maintaining awareness. The following image shows the various stages of the product life cycle and how the three analytics capabilities (Product, Content, Consumer) must evolve across the different stages of the product lifecycle.

Let’s explore the three analytics capabilities required at each stage of an Amazon product lifecycle:

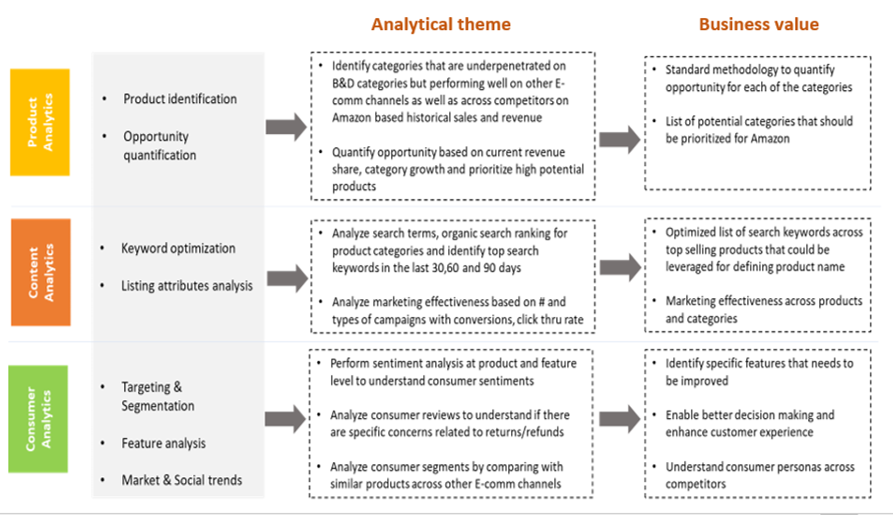

Stage 1 – Product Development and Launch

The process begins with generating ideas for completely new products or improvements to the existing range. Promising ideas move forward to assessing the opportunity, followed by identifying the content and the target segments.

Companies assessing to develop and launch a new product on Amazon can start analyzing the category/subcategory with the highest potential (products under these sub-categories that are performing well on other eCommerce channels) and the market size.

Machine learning algorithms can be leveraged to identify the category with the highest likelihood of success (definition of success can vary – million-dollar sales in a year, 1000 units of sales in a year, etc.). As a step further, once the highly successful subcategory is identified, machine learning algorithms can also be leveraged to cluster and identify the profile of these highly successful subcategories. Companies can also analyze search terms and marketing effectiveness of similar products under this subcategory and leverage those for optimizing the messaging content of the new product.

A large manufacturing client was keen on identifying subcategories with a higher likelihood of success ($1M sales in one year from launch) for new launches. Machine learning algorithms were built using historical data to assess market conditions that aid in product success. Top features from the ML algorithms were leveraged to identify subcategories that have a higher likelihood of success. Once a subcategory was identified, business users were also interested in understanding the profiles of specific subcategories to strategize the product launch. A highly concentrated subcategory would have a different strategy as compared to a highly fragmented one. Similarly, a high ROAS (Return on Ad Spend) subcategory would need a different strategy than those with low ROAS. The likelihood scores and the profiles of subcategories were very insightful for businesses to target the appropriate subcategory for launch.

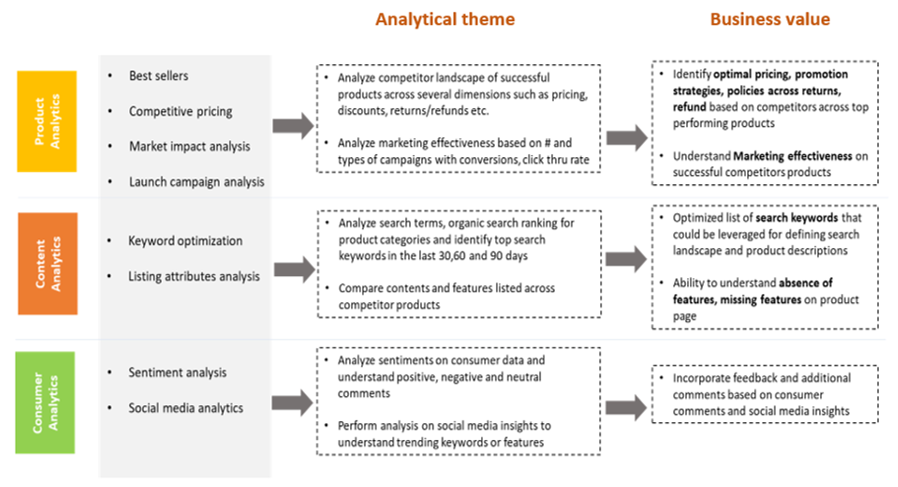

Stage 2 – Product Growth

This is the key stage for establishing a product’s position in a market, increasing sales, and improving profit margins.

Going by the same example above, once the subcategory is identified and a new product is launched, it is time to come up with the competitive landscape report that includes competitive pricing, discounts, and other levers that impact growth. Once that report is ready, it is essential to analyze the ideal time for running promotions, spend on advertisements, and the time to market.

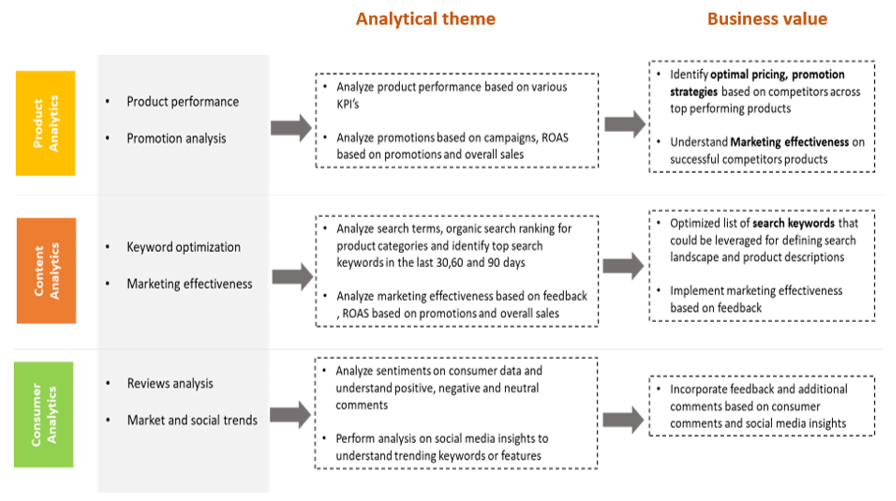

Stage 3 – Product Maturity

The maturity stage of the product life cycle shows that sales will eventually peak and then slow down. During this stage, sales growth has started to slow down, and the product has already reached widespread acceptance in the market.

Once the launched product has reached the maturity phase, marketing and promotions play a crucial role. Along with this, social media insights and understanding the trends related to this subcategory also become critical. Establishing several KPIs that enable companies to track the performance of the product against benchmarks thereby identifying the root cause would help companies zero in on the right levers.

Stage 4 – Product Decline

The decline stage of the product life cycle is the terminal stage where sales drop and production is ultimately discontinued.

As the product moves towards the decline phase, it might be time for the companies to monitor the profit of this product, assess if specific SKUs can be rationalized, and also gain learnings from consumer reviews which can be leveraged for subsequent product launches.

Conclusion

Amazon will continue to push its white labeled products directly competing with CPG brands. CPG companies can start a successful journey in Amazon using AI. This will help with their revenue growth and in capturing the untapped market by being a top category brand in Amazon. In addition, the experience will help CPG brands in setting up their own eCommerce channels in the long run, helping them break away from the ‘frenemy’ relationship status with Amazon.