Enterprise AI and machine learning models have long evolved from static tools to dynamic, autonomous systems that unlock new opportunities such as segment-of-one customer hyperpersonalization, actionable insights on demand, and faster risk assessments. This evolution demands a new level of discipline in how models are governed, monitored and explained. Model Risk Management (MRM) provides this monitoring rigour, ensuring the reliability, ethical adherence, and resilience of predictive algorithms and statistical models. It encompasses the comprehensive lifecycle of model governance, including design validation, performance monitoring, scenario testing, and the establishment of robust control frameworks designed to mitigate unintended bias, overfitting, or regulatory non-compliance.

At Tiger Analytics, we’ve partnered with Fortune 500 firms to embed AI into operations with full lifecycle oversight, blending domain expertise with engineering scale. This experience led to the development of the Tiger MLCore MRM platform specifically to address the challenge of governing rapidly expanding model inventories, enabling real-time oversight and compliance at scale. In this blog, we break down why MRM is a 2025 imperative, the operational and regulatory shifts driving this change, and how platforms like Tiger MLCore can streamline model governance, monitoring, and validation.

Why is Model Risk Management Critical in 2025?

As AI and machine learning grow more sophisticated, enterprises face increasing complexity in managing model compliance throughout the lifecycle, necessitating a proactive strategy. Analysts valued the global Model Risk Management market at $1.65 billion in 2024, with projections indicating a near doubling to $3.85 billion by 2033, representing a compound annual growth rate of 10% from 2025.

Furthermore, almost half of organizations surveyed for a 2025 Gartner report have invested in model security testing, while 41% have implemented runtime monitoring tools, indicating that continuous oversight is essential for real-time detection of drift, adversarial threats, or performance degradation. Based on our conversations with industry leaders, we’ve identified five key factors behind the growing importance of MRM in today’s enterprise landscape:

1. Model expansion and increased complexities

Businesses are experiencing a rapid surge in model utilization. Reports indicate that large banks are expanding their model inventories by 10%–25% annually, propelled by advanced AI, machine learning, and unconventional use cases consequently leading to increased validation backlogs and intricate challenges.

2. Model Risk Management moving from technical exercise to strategic function

Model Risk Management is evolving from a discipline solely focused on validation to a comprehensive governance pillar centered on risk. Financial institutions now oversee a wide array of model types, encompassing credit, market risk, business operations, and automated decision-making frameworks. The automation and tiering of validations, predicated on model criticality, have emerged as standard practices to optimize both efficiency and quality.

3. Growing regulatory pressure

Regulatory bodies globally are imposing stricter expectations. For example, in the US, financial regulators like the Federal Reserve and the OCC have implemented strict rules for managing financial models. Their ‘Supervisory Guidance on Model Risk Management’ (SR 11-7) defines model risk as “the potential for adverse consequences from decisions based on incorrect or misused model outputs and reports”. This guidance mandates robust governance frameworks, board-approved policies, and rigorous independent validations to ensure model integrity and control risk.

4. AI-driven risk detection and continuous monitoring

By 2027, it is projected that a majority of major enterprises will have adopted AI and machine learning tools for continuous regulatory compliance and risk monitoring, signaling a fundamental shift toward dynamic, real-time oversight. This trend is driven by the growing complexity of global regulations and the need for more efficient, data-driven approaches to maintain governance. Looking ahead, the integration of artificial intelligence and machine learning into core business functions continues to accelerate.

5. Broader Enterprise Risk Management evolution amid high stakes and limited confidence

A recent report found that only 18% of Enterprise Risk Management (ERM) leaders are confident in identifying and managing emerging risks, underscoring the need for effective, integrated systems like MRM to stay ahead of evolving threats.

At a Glance: MRM’s 2025 Imperatives

| Key Driver | Why It Matters |

|---|---|

| Model Proliferation | Exponential growth and diversification increase validation demands and complexity |

| Strategic Integration | MRM now underpins enterprise risk governance beyond technical review |

| Regulatory Tightening | Board involvement, documentation, and validation protocols are now expected |

| Real-Time AI Oversight | Continuous compliance monitoring ensures resilience and responsiveness |

| Inadequate ERM Confidence | MRM supports broader risk frameworks where leaders feel less equipped |

Challenges in Operationalizing Model Risk Management

While organizations recognize the importance of MRM, the challenge is operationalizing it effectively. About 50% of banks surveyed by McKinsey have integrated model risk into their risk appetite statements, but only 20% use specific KPIs to monitor model risk (such as performance metrics or validation results). While all surveyed banks have some model governance framework, 60% apply it only to their most critical models.

At the same time, MRM functions are evolving rapidly amid a growing number of models needing validation and risk reviews. Teams are under cost and capacity pressures, resulting in validation backlogs and uneven oversight. These operational gaps lead to inconsistent model performance, limited auditability, and exposure to financial, reputational, and legal risks. Standardized, scalable frameworks are necessary to ensure that models remain accurate, fair, explainable, and compliant in rapidly changing environments.

How Tiger MLCore Platform Streamlines Model Lifecycle Management

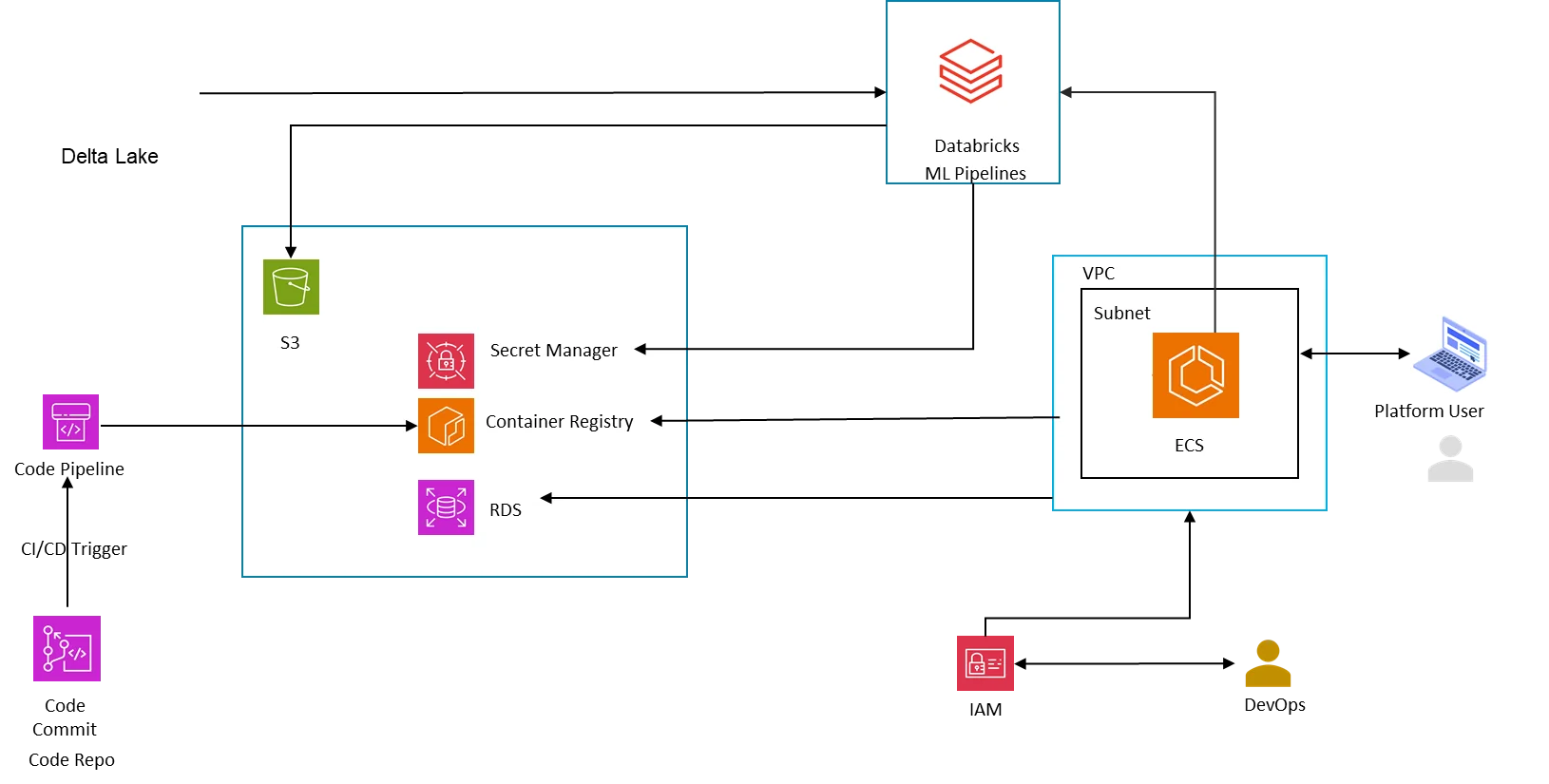

As oversight grows more complex, we observed that a single foundation that brings transparency, control and resilience to every stage of the ML lifecycle was a necessity. That’s why we built Tiger MLCore, a platform designed to simplify monitoring, governance, and explainability while keeping pace with the scale and diversity of enterprise AI. Below are some of the core features that make this possible:

Enterprise Deployment Dashboard: A unified view of all ML assets across cloud platforms and teams, with built-in performance monitoring for complete visibility.

Overview Dashboards: Customized ML Dashboards to easily analyze the consolidated performance of all ML assets and identify degradation across a host of metrics.

Self-Service Capabilities: End-to-end self-service features allowing data scientists and ML engineers to easily enable comprehensive tracking and monitoring for their projects with minimal configuration.

Performance Monitoring: Automatic performance monitoring for registered models across a wide range of model performance metrics.

Data Connectors for Legacy Models: Connect platform to legacy model data outputs and enable monitoring for legacy models.

Customizable Platform: Fully open source and can be customized for unique enterprise requirements.

Drift Monitoring: Drift detection supported by multiple algorithms with options for custom thresholds.

Model and Monitoring Explainability: Strong model and monitoring explainability features to help data scientists understand the root cause of drift and performance degradation.

Custom Alerts: Create and configure alerting rules customizable at the model, pipeline, and experiment levels to ensure the highest observability and

performance monitoring.

Caption: Model Monitoring Platform | Technical Architecture

Key Benefits of Tiger MLCore MRM Platform

1. End-to-End Model Lifecycle Governance

Automates model validation, monitoring, and documentation across development, deployment, and retirement phases.

2. Real-Time Drift & Risk Detection

Continuous monitoring to detect bias, data drift, adversarial attacks, and performance degradation as they happen.

3. Regulatory Compliance by Design

Built-in controls, audit trails, and reporting to meet SR 11-7 and evolving AI governance mandates.

4. Scalable & Flexible Architecture

Handles growing model inventories with automated tiering, workload prioritization, and seamless integration into enterprise systems.

5. Explainability & Transparency

Provides interpretable insights for stakeholders, improving trust in AI-driven decisions.

6. Operational Efficiency

Reduces validation backlogs and cost pressures through intelligent automation and workflow orchestration.

7. Enterprise Integration

Natively integrates with existing risk, data, and analytics ecosystems to strengthen overall Enterprise Risk Management (ERM).

8. Comprehensive Data and Model Observability

Built-in data quality monitoring, anomaly detection, drift and performance tracking provide transparency into data and model health with customizable dashboards.

9. Accelerated and Scalable ML Integration

Seamless integration with Unity Catalog, MLflow, reusable code templates, and flexible MLOps framework enable faster, standardized ML workflows that scale across diverse use cases and workloads.

10. Robust Risk and Approval Controls

Enables fine-grained multi-level approval processes, flexible risk reporting, and policy-driven alerting aligned with enterprise governance.

11. Built-in Model Explainability

Provides clear, interpretable insights into model decisions, enhancing trust and enabling stakeholders to understand and validate AI outcomes.

12. Robust Model Evaluation

Supports comprehensive evaluation workflows with automated validation and performance tracking, ensuring models meet quality and business objectives continuously.

13. Up-to-Date Documentation

MLCore’s built-in documentation continuously updates usage instructions, making the platform easier to use while enhancing transparency, traceability, and regulatory compliance.

As enterprises scale their reliance on predictive models and AI, the risks associated with bias, drift, compliance gaps, and operational failures have grown more pronounced. Model Risk Management has therefore evolved from a technical checkpoint into a strategic pillar of enterprise resilience, demanded by regulators and expected by boards. The imperatives for 2025 are clear: manage model proliferation, integrate MRM into enterprise risk frameworks, meet rising regulatory scrutiny, and adopt real-time AI-driven oversight.

References:

https://www.businessresearchinsights.com/market-reports/model-risk-management-market-113017/

https://hyperproof.io/resource/what-you-missed-at-gartner-security-risk-2025/

https://www.gartner.com/en/articles/2025-trends-for-enterprise-risk-management/

https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/the-evolution-of-model-risk-management/

https://www.mckinsey.com/capabilities/risk-and-resilience/our-insights/a-strategic-vision-for-model-risk-management/